It is possible that an invoice is made that is not paid, or needs to be paid. It is also possible that a credit invoice is made that is not settled. Then you will find an invoice and a refundable credit invoice in the membership card on the Financial statement tab.

These two rules can be booked in the journal memorandum against each other so that both come to 0 euro (paid). Together they deliver a result of 0 (zero) euros.

It may also be that part of the invoice has been paid and the other part does not have to be paid or credited. In both situations it means that a credit invoice can be deducted from an invoice.

This is done as follows:

• Select Accounting in the main menu

• Click on Books in the submenu

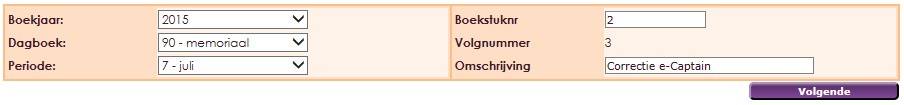

• Select the current financial year

• Select the Journal Memorandum

• Select the current month in Period

In the description you enter the name of the correction. For example, e-Captain correction

• Click the Next button

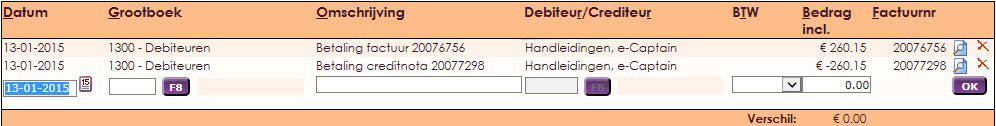

• Select the right debtor

• Select the outstanding invoice with the amount that has to be settled with the credit invoice

•Click the OK button

• Choose the same debtor again

• Select the outstanding invoice, the credit invoice, with the amount that is deducted from the first line

•Click the OK button

• A green large green finch icon appears in the upper right corner

• The two mentioned invoices are now settled with each other and the total is 0 (zero) euros.

Close.

Click on the membercard.

Go to the Financial tab.

The notes should no longer be outstanding.