You can set up your administration by means of the Accounting in the Management Center. In this section you provide settings that are used in the accounting of e-Captain.

In e-Captain you can preset a number of functions.

This way you can link the standard financial year to the settings. Always, if you want to book a sale or purchase, e-Captain will check whether you are working in the right financial year.

You can also indicate at the settings whether you want to work with cost centers when registering purchases, sales and more. Then you will get a table in sight with the cost centers that have defined.

Furthermore, you will set a number of standard accounts that appear in your general ledger scheme. If there is no ledger associated with a line that arrives in the accounts according to the image below, the relevant financial line will automatically be written to the corresponding standard general ledger account.

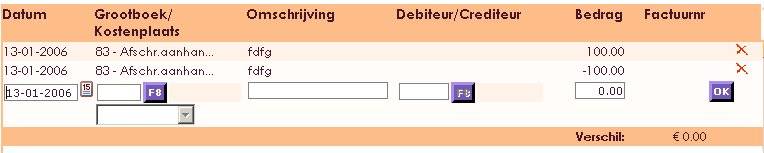

Under the F8 button you will find your own predefined ledger plan where you can retrieve the accounts you want to use.

After you have gone through all schedules or have created them (at your choice) then have checked or adjusted the settings, you can "switch on" the accounting.

Turning on the accounts ensures that all invoices are entered in the accounts as of the date you have placed. You can then only realize sales through e-Captain.

You are completely free on the purchase side. You can place all creditors that occur with the corresponding purchase invoices.

The members / relations you have in e-Captain have automatically become your debtors. So you can also realize the sales via the debtors only.

A separate sales invoice also goes through the "debtors". It is possible that you create a relationship with the name icidental sales, for example to cover the "foreign" invoices.

This function is intended to have a check done between the debtor administration and the balance of the debtors in the general ledger and the accounts payable and the balance of the creditors in the general ledger

The function tests whether the transactions in the general ledger (journal lines and general ledger lines) are equal to the balance of the outstanding items and of the balance shown in the relation (debtors / creditors).

If you have opened a new financial year, all balances are set to 0. There have been no changes in that year yet. In order to take over the balance of the previous year, you have to close the previous year. An opening balance for the new year will then be made.

If you do not want to close the previous financial year, but want to include the figures from the previous financial year, you can use the function: Create preliminary opening balance sheet.

If you have created a provisional opening balance, your bank and giro balances will also be taken over.

Note: It is possible that you yourself temporarily added the bank and giro balances in the memorandum of the new financial year. You must of course remove this booking to prevent bank and giro balances from being doubled.

After creating a provisional opening balance, you can still make changes in the previous financial year. If necessary, the opening balance of the new year will automatically be recalculated. This check / update takes place when you go to the function reporting.

A master roll is a group of accounts that have a connection within the accounting system. They are related densifications. You can create master strokes yourself.

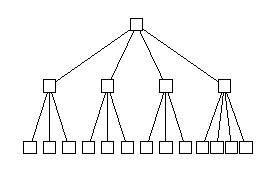

G / L accounts, densifications and main compunds can be used to group costs. This is clearly visible in the next image.

• In the top layer you will see the main densifications.

• In the middle layer you see the densifications.

• In the bottom layer you see all general ledger accounts

Costs can be divided into groups and even main groups. Below is an example from e-Captain of general ledger accounts that are grouped according to a compaction. The costs of the general ledger accounts all come together in the compaction with number 4 means of transport

| GROOTBOEKREKENING | VERDICHTING |

| 70 Personenauto’s | 4 – Transportmiddelen Balans Neutraal |

| 71 Bedrijfs-/vrachtauto’s | 4 – Transportmiddelen Balans Neutraal |

| 73 Aanhangwagen | 4 – Transportmiddelen Balans Neutraal |

| 80 Afschrijving personenauto’s | 4 – Transportmiddelen Balans Neutraal |

| 81 Afschrijving bedrijfs-/vrachtauto’s | 4 – Transportmiddelen Balans Neutraal |

| 83 Afschrijving aanhangwagens | 4 – Transportmiddelen Balans Neutraal |

Various densifications can be grouped back to main compaction as described in the example below. Number 4 contains transport resources in the densifications. This is grouped together with other densifications to the main compaction with number 2; tangible fixed assets

| VERDICHTING | HOOFDVERDICHTING |

| 1 Bedrijfsgebouwen en -terreinen | 2 – Materiële vaste Activa |

| 2 Inventaris | 2 – Materiële vaste Activa |

| 4 Transportmiddelen | 2 – Materiële vaste Activa |

| 6 Overige materiële vaste activa | 2 – Materiële vaste Activa |

This also means that short (compacted) lists can be printed. The overview that comes from e-Captain can be placed on 1 a4. if you want to print all bills, a "pack" of paper comes out of e-Captain.

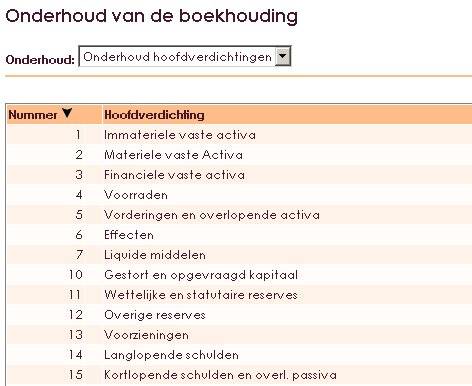

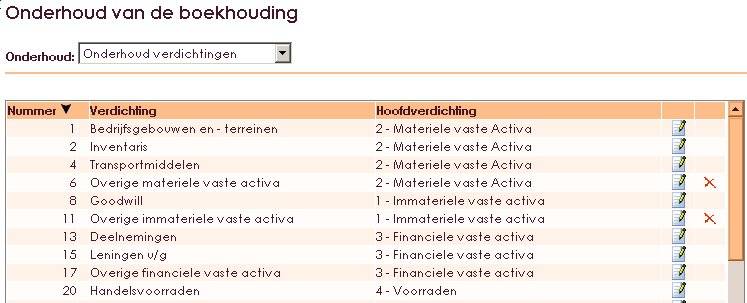

In e-Captain, the screen looks at major condensations as follows:

You enter the new and new master roll up by clicking the "new" button.

You can change and compile the main roll by clicking on the notepad at the back of the line.

A compaction is a group of accounts that have a coherence within the accounting system. Just like the main densifications. They are related densifications. You can create densifications yourself.

Ledger accounts, densifications and main compunds can be used to group costs. This is clearly visible in the following picture.

• In the top layer you will see the main densifications.

• In the middle layer you see the densifications.

• In the bottom layer you see all general ledger accounts.

Costs can be divided into groups and even main groups.

Below is an example from e-Captain of general ledger accounts that are grouped according to a compaction. The costs of the general ledger accounts all come together in the compaction with number 4 means of transport.

| GROOTBOEKREKENING | VERDICHTING |

| 70 Personenauto’s | 4 – Transportmiddelen Balans Neutraal |

| 71 Bedrijfs-/vrachtauto’s | 4 – Transportmiddelen Balans Neutraal |

| 73 Aanhangwagen | 4 – Transportmiddelen Balans Neutraal |

| 80 Afschrijving personenauto’s | 4 – Transportmiddelen Balans Neutraal |

| 81 Afschrijving bedrijfs-/vrachtauto’s | 4 – Transportmiddelen Balans Neutraal |

| 83 Afschrijving aanhangwagens | 4 – Transportmiddelen Balans Neutraal |

Various densifications can be grouped back to main compaction as described in the example below. Number 4 contains transport resources in the densifications. This is grouped together with other densifications to the main compaction with number 2; tangible fixed assets.

| VERDICHTING | HOOFDVERDICHTING |

| 1 Bedrijfsgebouwen en -terreinen | 2 – Materiële vaste Activa |

| 2 Inventaris | 2 – Materiële vaste Activa |

| 4 Transportmiddelen | 2 – Materiële vaste Activa |

| 6 Overige materiële vaste activa | 2 – Materiële vaste Activa |

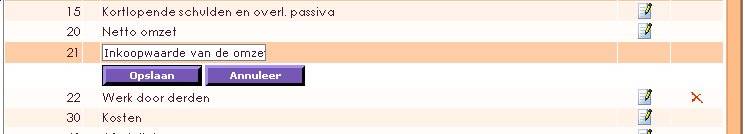

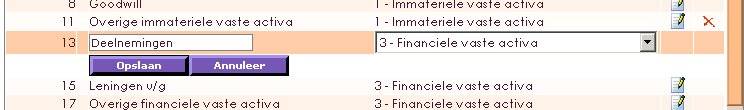

This also means that short (compacted) lists can be printed. The overview that comes from e-Captain can be placed on 1 a4. if you want to print all bills, a "pack" of paper comes out of e-Captain. In e-Captain the screen shows densifications as follows:

You enter the new and new compaction by clicking the "new" button. To change a compaction, click on the notepad at the end of the line.

A general ledger account is a collection of homonymous expense or income items that are brought together on a schedule. Each type gets an account number (not to be confused with a bank or giro number). This provides insight into the groups of finances that deal with a company, association, foundation. Each list that is created is given a unique number. All these lists together are called the general ledger scheme. For example, there will be many bills for, among other things, purchasing and sales.

Examples of general ledger accounts can be:

•travel expenses

• accommodation costs

• accommodation costs

• salaries

• computer costs

• advertising costs

Accounts can also have a connection within the accounting system. Just like the main densifications. They are related accounts. Eg travel and accommodation costs. You can create accounts yourself.

Ledger accounts, densifications and main compunds can be used to group costs. This is clearly visible in the following picture.

• In the top layer you will see the main densifications.

• In the middle layer you see the densifications.

• In the bottom layer you see all general ledger accounts.

Costs can be divided into groups and even main groups.

Below is an example from e-Captain of general ledger accounts that are grouped according to a compaction. The costs of the general ledger accounts all come together in the compaction with number 4 means of transport.

| GROOTBOEKREKENING | VERDICHTING |

| 70 Personenauto’s | 4 – Transportmiddelen Balans Neutraal |

| 71 Bedrijfs-/vrachtauto’s | 4 – Transportmiddelen Balans Neutraal |

| 73 Aanhangwagen | 4 – Transportmiddelen Balans Neutraal |

| 80 Afschrijving personenauto’s | 4 – Transportmiddelen Balans Neutraal |

| 81 Afschrijving bedrijfs-/vrachtauto’s | 4 – Transportmiddelen Balans Neutraal |

| 83 Afschrijving aanhangwagens | 4 – Transportmiddelen Balans Neutraal |

Various densifications can be grouped back to main compaction as described in the example below. Number 4 contains transport resources in the densifications. This is grouped together with other densifications to the main compaction with number 2; tangible fixed assets.

| VERDICHTING | HOOFDVERDICHTING |

| 1 Bedrijfsgebouwen en -terreinen | 2 – Materiële vaste Activa |

| 2 Inventaris | 2 – Materiële vaste Activa |

| 4 Transportmiddelen | 2 – Materiële vaste Activa |

| 6 Overige materiële vaste activa | 2 – Materiële vaste Activa |

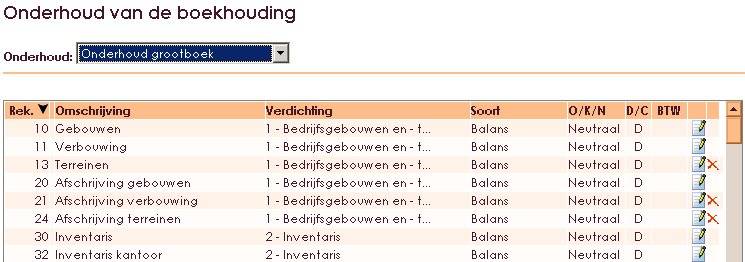

This also means that short (compacted) lists can be printed. The overview that comes from e-Captain can be placed on 1 a4. if you want to print all bills, a "pack" of paper comes out of e-Captain. In e-Captain the screen ledger scheme looks like this:

Entering a new account is done by clicking the New button. Changing an account is done by clicking on the notepad at the back of the line.

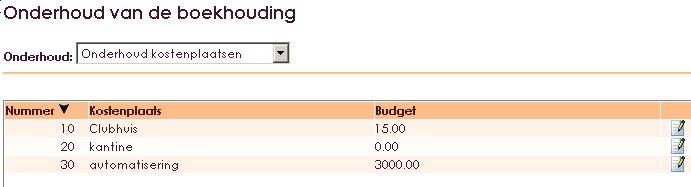

A cost center is an organizational unit (departments) that is not directly productive, but performs for other cost centers and thus has a service-oriented character. As an example, departments can be called maintenance, technical service, business office and drawing room

A cost center is also a business unit (cost grouping) that provides a certain kind of performance for the production process (performs a function). We use one cost center registration in e-Captain.

A cost center is also a not really existing part or department of a company, but a cost group that is made different for the costs. Examples of aid cost centers are the cost groups 'housing' and 'general management'.

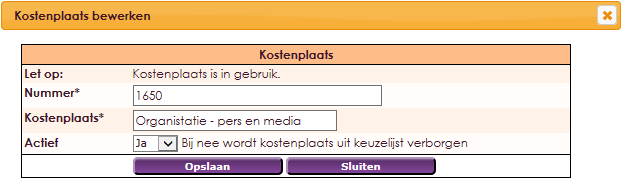

The cost center can be used when booking on the purchase and sale accounts.

Creating and maintaining cost centers can be done through accounting:

Here you find: create new cost center. Click Yes.

Confirm this by selecting OK.

You will now receive the following screen where you can add a new cost center that you can then use during booking.

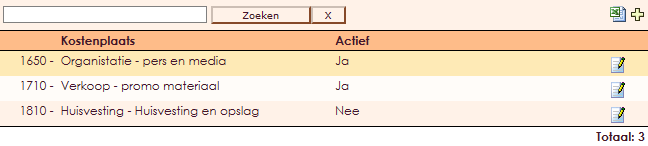

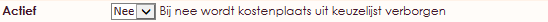

The cost center may not be in use, that is important!

• Click on Management Center in the main menu

• Select Accounting

• Click the Maintenance master data sub-item and choose Service cost center.

This will remove this cost center. Both when booking rules in the bank or elsewhere and in compiling reports, the cost center that is set to Active: No is no longer used.

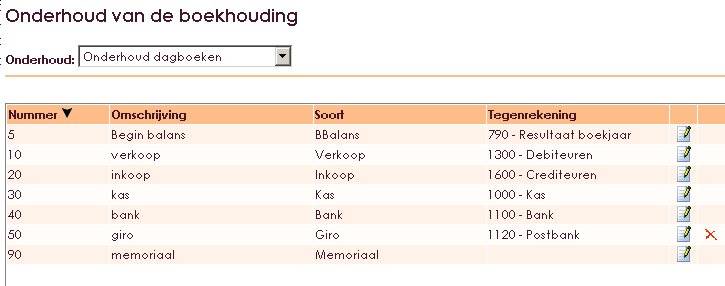

You have to read journals as are the accounts that you work with every day. The daily booking. You only use a limited number of "books" that you work on. Usually that is; cash, bank, giro, purchasing, sales and memorial.

An accounting program has a "books" part o.i.d. There one must choose a diary that one must have "created" in another part beforehand. In our case with maintenance - diaries. With that creation, that diary is "linked" to a ledger account you have chosen. Of course, the "bank" diary links you to the general ledger account "bank", "cash" to "cash", "sales book" to "debtors", "purchase book" to "creditors", the journal "memorial" has no link. (With the stock module, there are no diaries in accounting programs.)

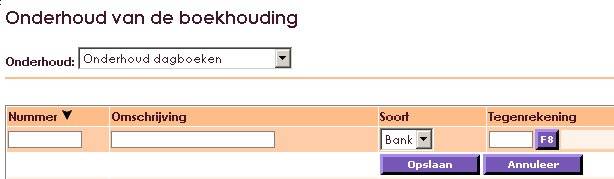

You must create a journal and a corresponding general ledger account for each bank or giro account and for every cash you have in your company. On the bank statement you note general ledger account numbers for the various transactions where they need to be posted.

You create a new diary by clicking the new button. You will then be asked whether you want to create a new diary in the diary schedule. e-Captain has standard 1 purchase diary and 1 sales diary. You can create more diaries for the bank and giro if, for example, you have several bank and giro accounts in use.

A financial year is the year on which a financial report runs. The annual report and the annual accounts are prepared for a financial year. In Europe, a financial year generally equals the calendar year, from 1 January to 1 January. In the United States a report is usually made from 1 June to 1 June and the financial year therefore runs over the calendar year limit.

A financial year can be set as default. This means that a check takes place on the date entered in a line during the booking. If the date meets the standard fiscal year, the rule is approved. If this does not suffice, you will receive a notification. It facilitates the entry and prevents you from booking incorrectly (in a wrong year).

A period table is linked to a financial year. In e-Captain you can choose whether you want to book in months or in quarters.

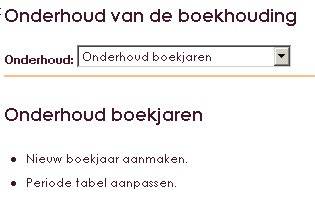

First we start with the period table. From the main menu go via Maintenance to financial years. The program requires a financial year. You can indicate whether that should become the standard financial year.

Then choose Generate Table. Then you opt for financial periods such as months or quarters. The program calls for the start month of the financial year; normally this is January, so 01. The table is now created. If necessary, data can still be changed.

If a table is booked, it can not be adjusted anymore.

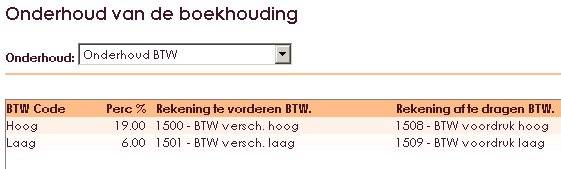

Note: In e-Captain 2 codes are created for each VAT rate, one for the rate excluding VAT, and the second for including VAT. In case you work with multiple rates, eg high, low or zero rate, you also have several codes.

VAT codes are used during booking to indicate in which VAT type a purchase or sale falls.