In the memorial often occasional bookings are processed that do not belong in the other diaries. The journal diary is often used for the year ending, the transfer of money from a general ledger account to another general ledger account, the debiting of various invoices for which you received only one (cumulated) amount, the booking of the payroll journal and the settlement of invoices (with credit bills). They are journal entries that do not involve a financial transaction. This means journal entries that do not have to do with expenses, receipt, purchase or sale. It also has nothing to do with buying or selling, so that the diary remains memorial.

A journal entry is always booked on two accounts. In addition, the one general ledger account becomes more and the other less, so there is always balance. By default, all expenses and receipts are processed through diaries. Journals have an automatic contra account, so that only one line needs to be entered.

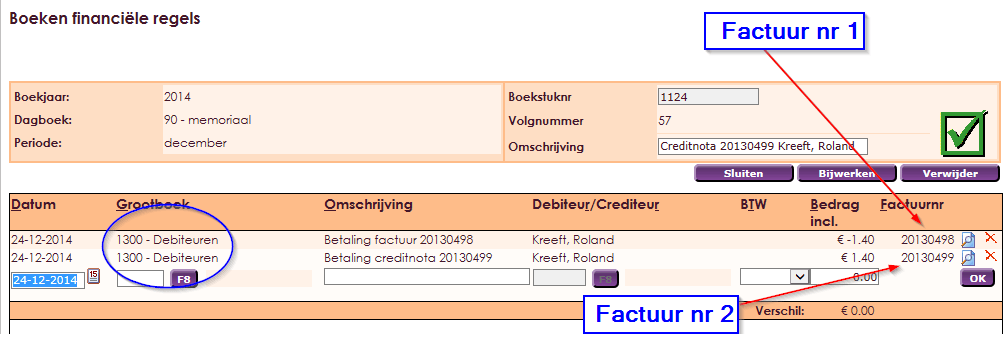

The memorial is a diary without automatic contra account. In the memorial, therefore, the entire journal entry must be booked with two lines.

Suppose you buy a new car for € 10,000. This is an investment (= holdings) that you post on the balance. Then the car gets older, starts to wear out and becomes worth less. If you estimate that the car will last for 10 years, you must write off 1/10 every year. Depreciation is not an outflow of money and therefore no expense. You record the depreciations in your profit and loss account as costs. The journal entry in the memorial is:

| Debet | Credit | ||

| Kosten | € 1.000 | ||

| a/ | Auto | € 1.000 |

| Debet | Credit | ||||

| Debiteuren | Debiteur A | Factuur 123 | € 1.000 | ||

| a/ | Debiteuren | Debiteur A | Factuur 456 | € 1.000 |

Now the invoice 123 is debited from debtor A (counter booked) with invoice 456. The total of the 2 amounts of the 2 invoices is € 0.00. Invoice 123 can even be larger than the credit invoice 456.

In this situation, the amount of invoice 123 is the amount that is equal to the amount of invoice 456. Invoice 123 will then still have to receive a remainder amount.