Cash journal

All cash transactions are recorded in the cash journal. The cash journal must be kept accurate because a reconstruction afterwards can often no longer be done. Every day the balance of the cash has to be found, it is clear that the cash can never be negative.

Depending on the size of the cash flows in your company, it is often advisable to keep these up-to-date (or weekly) in cash statements in which the totals of turnover and expenses have been kept. In the cash journal, the entries must be logically numbered with references to the relevant transaction.

Bank journal or Giro journal

For the bank journal and / or giro journal, in principle the same applies as for the cash journal. However, there is not much wrong with the bank and / or giro journal because all transactions are mentioned in the bank and / or giro statement. That is also the big advantage of bank and / or giro transactions, which are easy to trace. In addition, the beginning and end balance is always mentioned on the bank and / or giro statement, so any error is quickly noticed. A bank and / or giro statement can thus easily be processed in the administration.

TIP

If you have the choice between a cash transaction and a bank transaction, the bank transaction is preferred. This transaction is registered and dated in such a way that the information can not be lost.

The accounting in e-Captain works according to financial years and within a year in periods. You can choose monthly or quarterly periods through settings. During the booking process, a check will also take place on the date you use when booking, for example, a sales or purchase invoice.

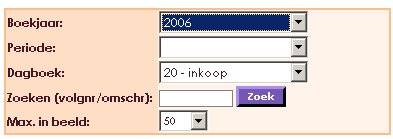

You choose when booking first for the year you want to book. You can indicate in your maintenance settings what your standard year is that you want to work in. This year will come standard when you book.

Then you choose the period you want to book. Depending on your settings, that is a specific month or a quarter.

Before you start to book you have to assess in which journal you want to book. Depending on the type of transaction you choose the required journal:

• Sales in the sales journal.

• Purchases in the purchase journal.

• Bank transactions in the bank journal.

• Giro transactions in the giro journal.

• Cash transactions in the cash journal.

• Correction bookings within your administration in the memorial journal.

You may have multiple bank and / or giro accounts. Then you will also have to create multiple bank and / or giro journal. If they are created, it is easy to give the journal the account number to quickly see in which journal you want to book.

In the above example you will see 2 extra fields.

The 1st field 'search' gives you the possibility to quickly search through all not yet processed bookings. You can also search specifically for a description you have entered or an entered sequence number. This can be the invoice number of your own invoicing or an invoice number of a supplier.

The 2nd field 'max in picture' indicates how many bookings are presented on your screen. If there are more than 50 lines in this case, a button will appear, followed by the 50 lines. You can then step through it step by step.

If you have indicated in the settings that you want to work with cost centers, you will also be offered these during the booking process. You can indicate in advance, for example, in an article line whether it should be written to a specific cost center. If you actually start booking, you will be offered more fields because the cost center table is also visible.

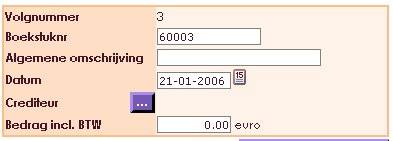

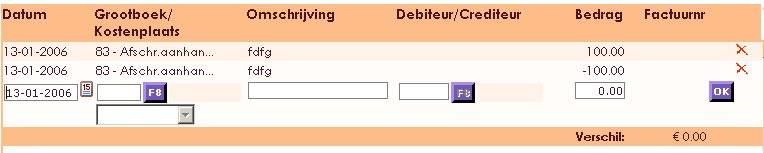

If a booking is correctly placed, you will see a green V on your screen at the top right, indicating that there is no difference in the booking. This does not indicate whether you have changed to the correct general ledger accounts, but only that the header is equal to the sublines in the booking.

If a booking is NOT placed correctly, you will see a red X in your screen at the top right, indicating that the placed rules do not include the full booking of the total amount you entered. So there is a difference. This does not indicate whether you have changed to the correct general ledger accounts, but only that the header is NOT the same as the sublines in the booking.

Provisional and final bookings

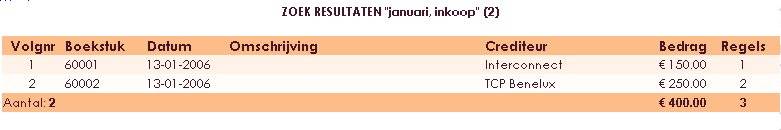

Entered journal entries are included in a booking sequence. A booking sequence contains the journal entries of, for example, telebanking, an invoice session or the booking of purchase invoices. All bookings are placed as provisional bookings. Provisional bookings can still be changed or deleted, from a definitive booking range only the description can be changed; these can no longer be removed.

The data from provisional bookings can also be included in financial statements, such as the diaries, the general ledger, the balance sheet and the outstanding items. You still have a complete overview of your financial situation. This is done through the question "after booking or after processing". After booking, the bookings are still provisional. After processing, the bookings are final. Provisional bookings can also be included in overviews for external use, such as reminders or the VAT return.

Journals, Journal and Ledger

The entered bookings can easily be found in the Diary (all bookings of a specific booklet together), in the Journal (all bookings in order of processing) and in the General Ledger (all bookings on a particular G / L account, so also of a certain amount). debtor or creditor, sorted by reference number or on posting date).